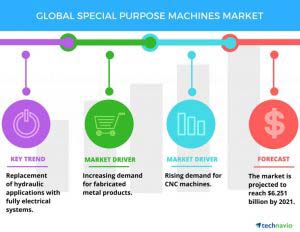

The global auto industry is more challenged than many people realize. On the surface, performance is strong. Worldwide sales reached a record 88 million autos in 2016, up 4.8 percent from a year earlier, and profit margins for suppliers and auto makers (also known as original equipment manufacturers, or OEMs) are at a 10-year high. Nonetheless, viewed through the lens of two critical performance indicators, the industry is in serious trouble.

Automotive operating margins are at a 10-year high

First, total shareholder return (TSR): Over the last five years, the annual rates of return that the S&P 500 and Dow Jones Industrial Average achieved for investors (including dividends) were 14.8 percent and 10.1 percent, respectively. In that period, average auto maker TSR was only 5.5 percent. Second, return on invested capital: In 2016, the top 10 OEMs returned an anemic 4 percent, about half of the industry’s cost of capital. The leading 100 suppliers have done a little better, just beating their costs of capital to enjoy a small positive return, after many years of negative net returns.

These numbers almost outweigh the positive sales and earnings results. They paint a picture of a sector that is a less attractive or less lucrative place to invest than other industries. This assessment suggests that there will be relatively few winners in the auto industry during the next five years and beyond. Those that do stand out will be the companies that harness their limited capital resources in creative ways, to navigate a still-unfolding and unfamiliar landscape.

To be sure, rates of return on capital have been a problem endemic to the auto industry for years, which is one reason for the many bankruptcies — or near liquidations — among OEMs and suppliers, particularly in the past decade or so. Surviving automotive companies have famously bent over backward to save pennies on every car or component they make. However, the situation is becoming more dire: The cost of capital is unlikely to come down from its already low inflation-adjusted levels, and new capital outlays are rising for advances in, among other areas, connected car and autonomous driving technology.

Indeed, what is particularly notable about the current wave of innovation in automobiles is not so much the speed with which it has emerged (though that is remarkable) as the breadth of the innovation — how much it is altering the basic contours and features of the traditional automobile and amplifying the difficulty and cost of manufacturing cars. Ubiquitous electronics, a variety of digital services, and novel powertrains and connectivity systems are hastening the need for expensive new parts, components, and functions. For OEMs, the price tag is high — as much as 20 percent greater than the cost of the previous generation of automobiles.

Many auto companies haven’t earned back their cost of capital

Consider the car’s interior, until recently a relatively stable component in terms of engineering and value to the automobile. Now, interior surfaces are potential real estate for ambitious enhancements of safety or entertainment. New technologies such as 3D laminated glass, haptic sensors, and augmented reality heads-up displays — which offer drivers alerts, safety aids, and warnings on invisible screens embedded in the windshield — have entered the vocabulary of traditional suppliers. Large navigation and entertainment display screens in the dashboard offer Web-based information and media as well as data arrays picked up from networked roads and other cars. The autonomous car will further up the ante, and soon. It will change the “living space” dimension of automotive interiors. The front seat may be reoriented to face the back seat, so passengers can converse as they would in their living rooms while the car cruises to a destination. Or seats could face a windshield that’s become a large movie screen. Little wonder, then, that vehicle electronics could account for up to 20 percent of a car’s value in the next two years, up from only about 13 percent in 2015.

Innovative software developments may make tomorrow’s vehicles exceptionally expensive: OEMs and suppliers must earmark resources for acquiring new technology and recruiting experienced technical talent. Many of the new features going into cars require the expertise of software engineers, who by and large prefer the ostensibly more dynamic work environments of Silicon Valley startups to those of the automotive industry. As a result, some of the recent mergers and acquisitions in the automobile sector were undertaken to augment in-house technical knowledge and capabilities. For instance, German supplier ZF Group, which paid US$12.4 billion in 2015 to acquire TRW in order to expand into the electronic safety and connectivity market, took a 40 percent stake in vehicle radar supplier Ibeo Automotive Systems in 2016.

Taken as a whole, innovation-related challenges are reshaping traditional auto industry structures and relationships — in particular, by threatening the existing distribution of profits and the boundaries between OEMs and Tier One or Tier Two suppliers, as well as between automotive and tech companies. Some suppliers will fold, as their business goes away completely, and others will struggle because changes in technology content will bring OEMs or non-automotive suppliers into their markets as new competitors. Decisions about investments and industry alliances that are being made now will determine the dominant positions of tomorrow.

The rising cost of safety and environmental regulations is also a concern for the industry. In the U.S., potential regulatory relaxation under the new administration has stirred at least some hope that higher costs associated with tightened emissions standards might arrive more slowly or even be avoided. However, there is a question whether a change in federal U.S. regulations would make a significant difference because individual U.S. states — and the whole of Europe — can continue to push for stricter standards. In addition, the regulatory requirements in other parts of the world are quickly catching up to those in the more regulated countries. For instance, China now has emissions standards for large cities similar to Europe’s, with only a brief (one- or two-year) grace period for smaller cities. Moreover, the real environmental challenges that underlie these trends are not going away and will ultimately have to be confronted.

Total OEM investments have been increasing

Considering these disparate pressures on costs, there is no easy formula that OEMs or suppliers can use to improve their return on capital. The solution will likely come from a combination of actions. Part of the answer lies in consolidation, which reduces industry capital requirements by eliminating competition and combining two manufacturing and design footprints into one. To a degree, these goals explain 2016’s robust supplier M&A volume, continuing the trend of the previous year’s record deal value, according to PwC’s Global Automotive M&A Deals Insights Year-end 2016 report.

However, consolidation is not the only solution — and in fact not even an attractive solution for companies struggling to fund new innovations. Auto makers in particular will need to examine other strategic channels for relief. We believe that OEMs should consider three actions:

Share platforms and manufacturing. When the goal is to improve efficiency in capital outlays, a good place to start is with platform (or chassis) and powertrain investments. Now that each auto maker is designing and building its own engines, transmissions, and related equipment, the amount of duplication within the industry is extraordinary. This is especially wasteful because consumers rarely buy cars for the platform — instead, they focus on such attributes as styling, quality, and reliability. Many OEMs, of course, already “repurpose” platforms across brands and models. However, platform sharing among OEMs is rare. One of the few examples is Nissan’s deal with Daimler to jointly develop the MFA platform, which is used on Nissan’s Infiniti QX30 model and Mercedes’ CLA and GLA models. In the U.S., GM and Ford are jointly designing a new 10-speed transmission (their second generation of transmission collaboration). In both cases, the companies expect cost savings, particularly in R&D and materials procurement.

If auto makers expanded their cooperative efforts, the industry would essentially be smart-sizing, the way the airplane manufacturing sector has over its long history. In the very beginning of aeronautics, the Wright Brothers and companies that grew in their wake made their own engines. Before long, a group of separate businesses emerged to produce engines, each of them competing to improve and advance the equipment. As aircraft engine technology advanced rapidly, jet engines became the dominant design — and having a spate of companies making the same part proved costly. The industry responded by consolidating, resulting in just a few independent aircraft engine manufacturers and a more efficient supply market.

The similarity to having many OEMs and suppliers producing virtually the same automobile transmissions is clear. An approach like the aircraft industry’s may lead to potentially more valuable auto partnerships than platform sharing: namely, jointly manufacturing vehicles. This, too, is already happening in isolated cases. The difficulty of eking out profits from small cars long ago prompted Toyota and Groupe PSA to share production at a plant in Kolin, in the Czech Republic. Similarly, we have seen rebadging across brands in markets where sales volume is low. For instance, Renault, Nissan, and GM have been cooperating in manufacturing some light commercial vehicles, virtually identical products sold under three different brands.

By removing excess capacity and concentrating supply, these collaborative solutions offer some of the same benefits as industry consolidation — in particular, improvements in capital efficiency and capital returns.

Offload more development work to technology suppliers. Many automotive companies are highly involved in developing the new technologies their customers want — whether it is the human–machine interface for infotainment, autonomous features, or the components for electrification. OEMs need to identify which aspects of a vehicle’s digital features they can hand off to tech industry partners that have more expertise in designing and producing digital components and software.

In these relationships with Silicon Valley, OEMs can retain a proprietary hold on interfaces as well as on connectivity and infotainment systems that distinguish them from competitors. Some early initiatives (such as BMW i Ventures, a venture capital fund based in Silicon Valley, and Toyota Connected, a partnership with Microsoft) offer glimpses of how the auto–tech ecosystem might work.

Redesign distribution models.Upward of 15 percent of a car’s cost typically goes to distribution. There is of course some variation by country and segment; for instance, fleet sales are less expensive than retail. However, the percentage is generally higher than it needs to be. Although OEMs are locked into dealer relationships in the U.S. and Europe by complex and often antediluvian rules, they should begin to explore and lobby for approaches that will reduce their costs by using more efficient channels to reach car buyers. These changes in the distribution system should ultimately aim to cut costs by minimizing the number and expense of retail outlets and using technology for better inventory control.

Savings could come from selling via Web channels. In the U.S., OEMs are barred from bypassing dealerships, a prohibition that electric carmaker Tesla is campaigning to eliminate. Rather than opposing Tesla, as some auto makers have, U.S. OEMs should view this potential change as an opportunity to innovate. OEMs are finding that as customers use the Internet to research car purchases, they do less shopping in person. Car buyers are now visiting between one and one-and-a-half dealers before buying a car, compared with visiting four or five a generation ago. Using analytics to assess this data for demographic and location trends, auto makers hope to gain savings from inventory and dealer facilities management. They can target customer preferences more effectively and place the appropriate mix of retail formats in the right areas.

Improving the dealer model would be a plus for OEMs and a relief for customers, who by and large want a haggle-free, simple experience — and can’t seem to find one. That is why in the U.S., the auto sales program of warehouse club Costco, which represents consumers in negotiations with car dealers, has become popular. Costco assisted on almost half a million car purchases in 2015, comparable to the volume at some of the country’s top dealership groups.

Broadly speaking, OEMs have more leeway than suppliers to implement aspects of this road map — largely because they are at the top of the food chain and in a better position to influence ground rules than those below them. Given these constraints, suppliers should focus on two areas. First, they should position themselves in a profitable part of the vehicle ecosystem. Whether the end product is differentiated or a commodity, suppliers need to be sure they have the best organizational and operational capabilities for their niche in the current and future industry structure. Second, they need to optimize their business model. For suppliers of commodities, this involves a relentless focus on minimizing costs. For other suppliers that are able to differentiate their products or operations — through technology innovation, patents, an advantageous manufacturing footprint, or superior logistics and supply chains — the challenge is to build upon these assets by creatively upgrading them while enjoying the benefits of the price premium. In short, suppliers must recognize the world they inhabit and make sure that they can effectively navigate it.