Punch Powertrain’s Gert-Jan Vogelaar tells Michael Nash about innovative new powertrain technologies that are set to make their way to market over the next five years

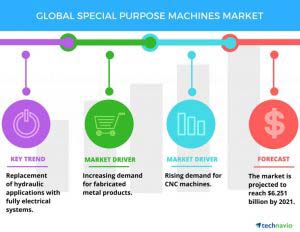

Predicting the acceptance of new technologies in the automotive industry is an extremely challenging task. OEMs and suppliers invest millions of dollars in the design, development and production of solutions, in the hope of winning new customers and reaching markets.

With increasingly stringent emissions and fuel economy regulations looming across the world, powertrain engineers are examining the viability of numerous technologies that are yet to reach mass production in the passenger vehicle segment. The level of adoption and acceptance of these technologies could vary considerably when considering markets like Europe, the US and Asia, for example.

Expansion through R&D

Punch Powertrain, which grew out of a former DAF subsidiary, started to produce continuously variable transmissions (CVTs) for rear-wheel drive (RWD) vehicles in the mid-1970s. It almost exclusively supplied its product to Volvo after being acquired by the Swedish OEM in 1975.

Since splitting from Volvo in the early 1990s, Punch has expanded its portfolio considerably, and continues to do so through research and development. Speaking to Megatrends, Gert-Jan Vogelaar, the company’s Strategic Marketing Director, emphasised the importance of this continuous expansion.

“When Punch first started we were a one-customer business, but now we’ve managed to create a large base of clients,” affirmed Vogelaar. “We invest the money we make on sales in the development of new products, and we need these new products to increase our geographical footprint.”

Punch’s latest CVT is called VT5, and is slated to reach production in 2017. It is based on the company’s existing VT2 and VT3 transmissions, but has the world’s largest ratio coverage for a single CVT transmission. Vogelaar described the steps that Punch has been taking before the VT5 enters production.

The cost challenge

“The first part was to ensure we had more customers for our VT2 and VT3 transmissions,” he revealed. “Once we had those, we had the money to invest in new technologies. Our current CVT products don’t have torque converters, which is the number one requirement for an automatic transmission in the US.”

Vogelaar also noted that while CVTs are not particularly popular in Europe, they are in high demand across Asia. To tackle the European market, Punch decided to start the development of a dual clutch transmission (DCT). “DCTs aren’t really a very cost effective solution at the moment, but we think we can give them a much better chance to succeed,” Vogelaar suggested. “We chose to develop the DCT because we saw a space in both the Asian and European markets.”

There is an increasing interest from OEMs in solutions that do not use rare earth materials because of the significant cost reduction. I think this will be a significant factor for the future of motor solutions

Cost is the number one challenge facing the mass adoption of DCTs, continued Vogelaar. Therefore, Punch’s aim is to produce a DCT that is cheaper rather than more expensive than a CVT, and will target segments that currently use automatic manual transmissions. “These segments are traditionally those with the cheaper cars, and we think we have a concept DCT solution that will cost only slightly more than an AMT,” he predicted.

Vogelaar is confident that, by offering the VT5 CVT and a DCT, Punch will be able to meet the demands of the Chinese, US and European consumers. “Our market base will be global, which is a critical part of our company’s strategy,” he emphasised.

Motoring ahead

Before the supplier started developing the VT5, it focused heavily on its hybrid powertrain and Switch Reluctance Electric Motor (SRM) technology. In a recent Automotive World webinar, Saphir Faid, Manager Advanced Development, Punch Powertrain, described the variety of motors available for electric and hybrid vehicles. The SRM was highlighted as a particularly promising architecture.

“The development of motors is heading in quite a few different directions,” Vogelaar mused. “We’ve been focusing on SRM technology, which we originally planned to introduce on our first hybrid powertrains. But it did not fulfil all the different requirements coming from all our different customers. Some were pleased with the results, but some had issues with the noise, vibration and harshness (NVH) levels.”

In order to meet legislation, OEMs must improve the efficiency and lower the emissions of their vehicles, otherwise they will be unable to bring certain vehicles to market

As a result, Punch decided to launch its hybrid powertrain solution with a permanent magnet electric motor, but continued with the development of SRMs for electric vehicles (EVs). It was recently involved in a European project with several partners to develop a fully integrated electric powertrain with a SRM, the gearbox and the power electronics in one package. The system was then installed in a BMW i3 demonstration vehicle. “We found that the NVH issues were completely gone, and the typical SRM issues that we had with torque ripple were resolved,” explained Vogelaar. “I think we really made a big breakthrough with the technology in this project.”

Discussing the possibility of bringing the SRM to production, Vogelaar said that the general base design is finalised, but “the industrialisation process is yet to start. It has to go through the standard product creation process with all the various sample phases,” he explained.

One of the key factors that is beneficial to the production of SRM technology, as well as to the end user, is that it does not include rare earth materials in its design. “There is an increasing interest from OEMs in solutions that do not use rare earth materials because of the significant cost reduction,” Vogelaar affirmed. “I think this will be a significant factor for the future of motor solutions, and am confident that Punch has a very good solution with the SRM technology.”

Changes in China

Discussing the evolution of powertrain technology in general during the next five to ten years, Vogelaar said that each market is likely to move at different paces. “I also think there will be different approaches around the world, depending on what level of technology is available,” he mused. “If you look at China, for example, there will be some huge improvements in the efficiency and performance of combustion engines. However, I think the country might skip certain steps, and find it more cost efficient not to put all the focus on the engine but to introduce 48-volt (48-v) systems, for example.”

If you look at China, for example, there will be some huge improvements in the efficiency and performance of combustion engines. However, I think the country might skip certain steps, and find it more cost efficient to introduce 48-volt systems, for example

Punch Powertrain, he revealed, is preparing to introduce a 48-v system to market in 2017, with the primary target market being Asia. As for battery electric vehicles (BEVs), Vogelaar thinks they will be an attractive solution for China. “These two electrified architectures will probably do better in China than in the rest of the world,” he predicted. This is partly due to the incentives provided by the Chinese government that have spurred sales in electrified vehicles.

“The authorities have been keeping the carrot in front of the customers, especially in certain cities like Shanghai, which had a huge incentive for plug-in hybrid electric vehicles,” he explained. “However, many of the subsidies that were given to OEMs have now been put on hold, and in general, incentives will be reduced in the coming years.”

The primary factors pushing the adoption of electrified vehicles in China, Vogelaar continued, are the fuel economy and emissions regulations. “In order to meet legislation, OEMs must improve the efficiency and lower the emissions of their vehicles, otherwise they will be unable to bring certain vehicles to market.”

Looking ahead, Vogelaar said there could soon be some changes that will impact heavily on the Chinese vehicle mix: “Nothing is official yet, but from what we are told, the system and regulations may change and there will be a huge trend towards mild hybrids. This will result in more 48-v solutions on the market in China, rather than the plug-ins we see today. These vehicles could account for anywhere between 40% and 50% of an OEM’s fleet mix, depending on their strategy.”

When considering the numerous different products that Punch has in development and production, Vogelaar admitted that there is a “difficult juggling act to perform.” He stressed the variation of “challenging consumer demands” from across the world, and how they put a strain on companies to develop a wide range of new technologies. “Optimising a powertrain portfolio is all about trying to select the right solution for the right market, and being there at the right time,” he concluded.